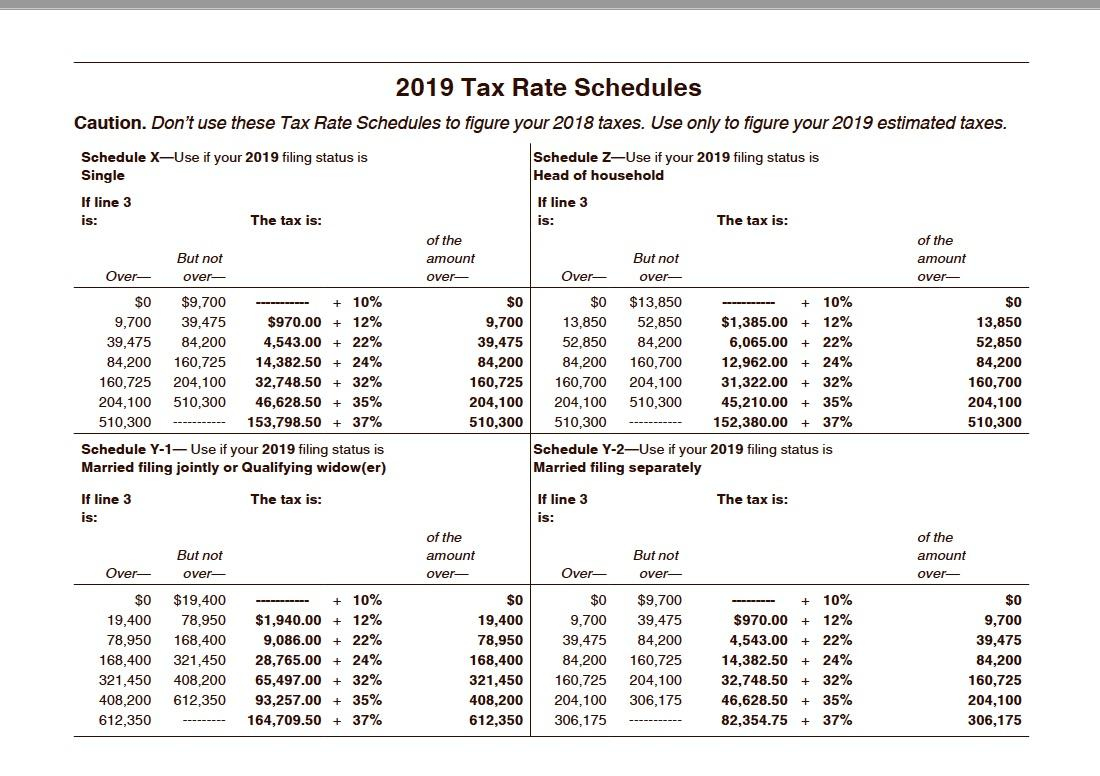

In a progressive individual or corporate income tax system, rates rise as income increases.

,” when people are pushed into higher income tax bracket A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status.

Many tax provisions-both at the federal and state level-are adjusted for inflation. This is done to prevent what is called “ bracket creep Bracket creep occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. Bracket creep results in an increase in income taxes without an increase in real income. It is sometimes referred to as a “ hidden tax,” as it leaves taxpayers less well-off due to higher costs and “ bracket creep,” while increasing the government’s spending power. The same paycheck covers less goods, services, and bills. Provisions for inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets.

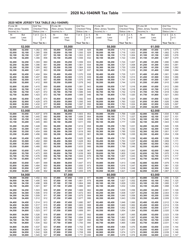

#1040 TAX TABLES 2020 ARCHIVE#

#1040 TAX TABLES 2020 HOW TO#

Local Income Tax Rate Changes - Instructions on how to notify the State of Maryland Comptroller's Office of changes to local income tax rates by counties.

Also included in the distribution of local income tax revenue are comparisons of delinquent distributions and fiduciary distributions by county, (net of municipalities) and by municipality.

#1040 TAX TABLES 2020 CODE#

Pursuant to Annotated Code of Maryland, Tax-General Article § 10-106(b), a county must provide notice of a county income tax rate change to the Comptroller on or before July 1 prior to the effective date of the rate change. Notification of Local Rate Change to Comptroller 0275 for taxpayers with Maryland taxable income of $50,000 or less and a filing status of single, married filing separately, and dependent and

0275 for taxpayers with Maryland taxable income of $100,000 or less and a filing status of married filing joint, head of household, and qualifying widow(er) with dependent child The local tax rates for taxable year 2023 are as follows: 0281 of an individual’s Maryland taxable income in excess of $50,000. 0270 of an individual’s Maryland taxable income of $1 through $50,000 and Taxpayers Filing Joint Returns, Head of Household, or Qualifying Widows/Widowers 2022 Maryland Income Tax Rates Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries

0 kommentar(er)

0 kommentar(er)